The landscape of pet buying behavior has undergone significant shifts in recent years, particularly in the wake of the COVID-19 pandemic. More pet owners’ spending habits are stabilizing, with less reporting increases to their overall pet expenditures since 2022. This suggests that pet owners are settling into new spending patterns, which is valuable information for businesses looking to understand and cater to their customer base.

Where do Pet Owners Shop in 2024?

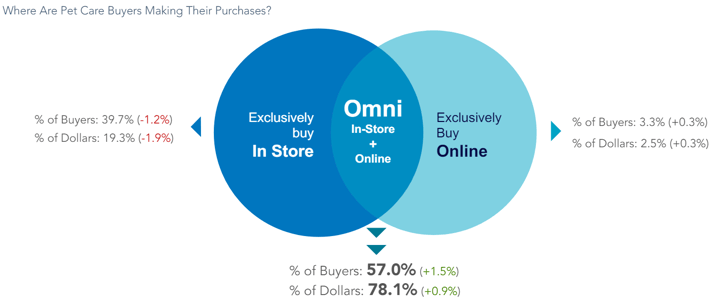

In the National Pet Owners Survey, which APPA now conducts annually, pet care buyers were asked where they make their purchases.

- Nearly 80% of all dollars spent on pet care are spent by omni-shoppers, and 57% of buyers shop both in-store and online1

- 39.7% of buyers exclusively buy in-store1

- 3.35% of buyers exclusively buy online1

Online Purchasing Remains an Important Pet Retail Channel

Pet Spending Grows Modestly Alongside Inflation

At the end of 2023, more than 113 million households were buying pet products, with an average value per buyer of $738. That’s a 7.4% increase over the previous year and rising.4 As of 2024, “spending habits are stabilizing, with less reporting increases to their overall pet expenditures since 2022.”5 Inflation is likely a significant factor influencing pet owners' decision to spend less. Despite this, it's noteworthy that employment for pet owners has remained relatively stable, with most indicating that the economy has not adversely affected their employment status. Nevertheless, 19% of pet owners have reported experiencing some form of employment disruption, such as reductions in hours or furloughs, which could further contribute to the decrease in spending.6

Branding Plays a Big Part in Purchasing Decisions

Discover More Pet Owner Spending Trends with APPA’s Strategic Insights Report

Access more detailed data on pet owner consumer behavior when you access APPA’s report, APPA’s State of the Industry 2024: Strategic Insights from the National Pet Owner Survey for economic insights, pet owner spending habits, and pet ownership trends.

Subscribe to our newsletter

Get recent blog articles, information about APPA research publications, regulatory updates, and upcoming event details.

APPA Releases Comprehensive 2025 Report on Bird, Small Animal & Horse Ownership

New insights uncover shifting demographics, new purchasing preferences and rising engagement in today's pet owners.

APPA Launches Pets Add Life Holiday Gift Guide Highlighting Emerging Pet Trends

Celebrating the joy of pets with a curated collection of innovative and festive gifts for pets and the people who love them.

From Bigger Tanks to Stronger Bonds: Fish & Reptile Ownership Evolves in 2025

APPA's latest report reveals shifting demographics, rising engagement, and the important role smaller pets have in U.S. households